by lilibalfour | | think

I wrote about the long and arduous IPO path a while back. Here we discuss the equally daunting mergers and acquisitions (M&A) path.

The growing trend in early-stage M&A is to ditch the suits. According to Dealogic, 73% of acquirers utilized a formal investment banking firm in 2003. By 2013, only 31% of acquirers used a formal investment banking firm. Ironically, M&A volume has increased, not decreased.

Acquirers, typically large technology firms with cash to burn, are recruiting classically trained investment bankers and training them to identify early stage opportunities. We call this function corporate development, as the role finds holes in the corporation’s current technology and uses acquisitions to develop these areas. The focus is not so much on revenue, but product and staffing needs. Hence, the newly coined term acquihire, which occurs when you can’t hire engineers so you acquire them.

On the other side of the transaction, the acquisition targets don’t have the resources to recruit a corporate development team. However, early stage companies need to be armed with the same expertise. They need acquirer research, a valuation estimate, and a negotiation plan.

Here’s what you need to do it yourself:

Acquirer Research – Begin reviewing your competitive landscape for companies that may work well with your team. Look for companies that share your culture, value, and vision. It’s good to get to know these companies before you need them. Strategic partnerships are a great way to test the waters.

Valuation Estimate – Be armed with a valuation estimate based on related transactions in your industry. You can pay for a service that tracks these numbers or you can research them on your own. This guide to valuing your company explains the methodology.

Negotiation Plan – If you do your homework (know what you’re worth) and have discussed all the possible outcomes (asset sale, equity sale, or acquihire) you should be able to set parameters for negotiating the transaction.

Closing the Deal

Most acquisitions will require you to stay around. If it’s an acqui-hire, the assumption is that you are now an employee of the acquirer. If it’s a traditional equity sale, you will more than likely receive an earn-out in your offer. For example, you will be required to stay on for a set period of time to earn additional compensation based on the company’s performance. If it’s an asset sale, you are simply selling certain assets and in most cases won’t be required to tag along.

It is critical that you understand what the “NewCo” will look like. Will you be replacing an existing team? Perhaps you are tasked with creating a new division. Make sure you are on board with the integration schedule. If not, it could hamper your ability to receive compensation outlined in the earn-out.

Need help putting together your valuation? Check out The Guide to Valuing Your Company here.

by lilibalfour | | think

It is true that there are fewer women getting funded and building billion dollar companies. The numbers are improving, yet we still have a long way to go. The answer to this problem is to start early and to focus on the internal factors causing this imbalance.

“What’s holding you back is the thought that something is holding you back.” Ralph Marston

I was raised with four siblings. I am the only one who graduated from high school. I later went on to college to study finance and today I run a financial advisory firm that helps early-stage companies get funded. The only difference between my siblings and me is I decided to follow a different path. My internal message set me on that path.

Nobody claims being a pioneer is easy but it is always worth it. With each victory, I am able to find strength to climb higher. I fall. I make mistakes. Yet each mistake I make helps me to learn more about myself and to grow. My internal message is that failure is part of the process. I don’t worry about failing. I worry about stagnating.

It’s Not About My Gender

In my 20’s, I worked in technology M&A. I was the only female on my team and the only team member who did not have both a degree in electrical engineering and an MBA. I struggled to keep up with my peers. I constantly complained to friends that I was being treated differently because I was female. Today, I can see that I struggled because I did not have the same knowledge as my team members. My work was not always up to par because I lacked a solid background in technology. This explains why I was treated differently.

When we get honest, we get better. I gain nothing by blaming my gender. When I look at my own deficiencies, I am empowered to improve my skills. I still don’t have an electrical engineering degree. I don’t code. I don’t consider myself to be tech savvy. Yet, I take the time to understand technology well enough to do my work. Nobody is holding me back from learning. Nobody.

Telling Your Financial Story

If you are building a company, you need to understand the numbers. I know that is not always easy to do. A female engineer once said, “When I see a dollar sign in front of a number I panic.” Calculus was easy for her, but finance was hard. Her internal message was that finance was difficult.

When you understand how money is coming in and out of your company, you increase your chances of success. If you can understand basic addition and subtraction, you can understand your company’s income statement.

Tell Investors What They Want to Hear

When you talk to investors in the language they want to hear, you increase your chances of getting funded. Investors will invest when you show them you know how to make money.

Do you know your revenue metrics? If you are in the retail business, you want to track your sales per square foot (SPSF). A company like Gap will see $300 in SPSF while a company like Warby Parker will see well over $3,000 in SPSF. If you are operating an online business, you want to know your average revenue per user (ARPU). Amazon has $500 in ARPU while Facebook only has $5.

Once you’ve determined your revenue metrics, you can measure against your peers. Are you outpacing your peer group? If you’re not, find out how you can improve your numbers.

Remember: Investors are investing for financial return. They want to know how your company is going to make money and a return.

Taking My Own Medicine

I don’t believe building a billion dollar business is easy. In fact, a friend and I recently started a support group called Billionaire Babes. We realized we both needed help in growing our companies. We get together to discuss revenue generation for our respective companies and to hone in on our weaknesses. My goal is to build a billion dollar company in the next five years. In order to do that, I need to work on my internal messaging by rewiring my brain.

If you are not already in a similar group, I strongly suggest you form one. Women have an entirely different internal message about money. We were not raised to think about making money. We were not taught about wealth creation. The good news: Nobody is holding us back from learning. Nobody.

by lilibalfour | | think

How Entrepreneurs Can Raise Capital With Ease

The future looks bright for early-stage companies seeking capital as we prepare to celebrate the one-year anniversary of the JOBS Act – Title I.

Emerging growth companies (defined as a company with total annual gross revenues of less than $1 billion during its most recently completed fiscal year) have enjoyed relaxed requirements around fund raising in the public market. Title I allows companies to submit only two years of audited financial statements, report as a Smaller Reporting Company, and avoid the standard requirement for Sarbanes-Oxley Act. In addition, companies seeking to raise capital from the public market can now submit a confidential S-1 in an effort to test the waters. This allows companies to receive feedback from the SEC prior to committing to a formal initial public offering (IPO).

During the 12-month period from September 15 2013 to September 15, 2014, approximately 370 companies filed to go public. In contrast, only 256 companies filed to go public in the calendar year of 2013.

For early-stage companies attempting to raise capital from the private markets, Title I allows for less regulation around general solicitation and advertising of privately held securities. In simple terms, it allows entrepreneurs the ability to publicly advertise their fund raising efforts. The main caveat is investors must be accredited and entrepreneurs are required by law to ensure investor accreditation by reviewing credit reports, tax filings, and bank statements.

Entrepreneurs can alleviate the verification burden by utilizing fund raising platforms, which verify investor accreditation free of charge. The pioneer in fund raising platforms, AngelList, was founded in early 2010 and to date has facilitated over $200 million in investments.

Syndicates Streamline the Process

At the end of 2013, AngelList announced a Syndicate Program, allowing angel investors to raise committed capital for future investments. This program enhanced entrepreneurs’ ability to target seasoned investors with solid track records. Today, the top syndicate, Gil Penchina, has raised close to $4,500,000 to back promising entrepreneurs.

Pooled capital makes fund raising easier for entrepreneurs who previously needed to reach out to several dozen investors before getting a lead or anchor investor. Entrepreneurs can now focus on syndicates the same way they focus on venture capital funds.

Fund Raising Ecosystem

There are other public platforms available. Second to AngelList is Onevest (a merger of RockThePost and CoFoundersLab), which is backed by Shark Tank’s Barbara Corcoran. RockThePost was founded in late 2011 and to date has facilitated over $90 million in investments. The main difference between AngelList and Onevest is the former is investor focused. On Onevest, entrepreneurs cannot view investor profiles and determine which investor would be the best match for his or her company. However, RockThePost offers educational events for both investors and entrepreneurs.

The Key to Accessing Capital Quick

Investors put their money into companies that have traction. This traction may be in the form of revenue, customers, or simple investor interest. Entrepreneurs should study the investor landscape, secure a lead or anchor investor, and then display their company’s profile publicly.

The world of finance is flattening. It has never been a better time for early-stage companies to raise capital. With SEC relaxing requirements and technology bringing people together, entrepreneurs are raising capital with ease.

by lilibalfour | | think

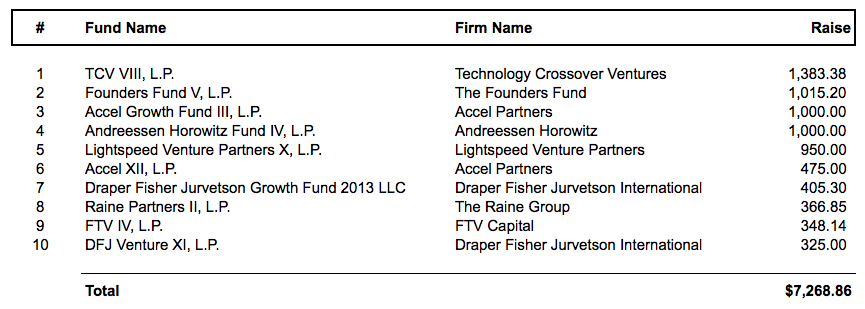

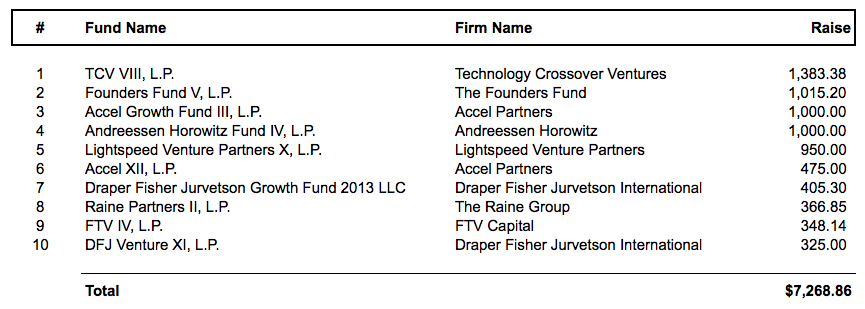

The Top 10 US-based venture capital funds, based on amount of capital raised during the first quarter of 2014, pulled in $7.3 billion over 8 venture capital firms. Accel Partners and Draper Fisher Jurvetson each raised two funds. When it rains it pours.

The first quarter of 2014 was a record breaking quarter and serves as promise that venture capital, as an asset class, is on the ascend. The amount of capital raised in the fourth quarter was up 81% from the fourth quarter of 2013 and up over 100% from the first quarter of 2013. Moreover, the first quarter of 2014 marks the strongest quarter for venture capital fundraising since the fourth quarter of 2007, when $10.4 billion was raised.

Technology Crossover Ventures raised the largest amount of capital at $1,383,380,000 as of March 31, 2014, with a $2,500,000,000 overall target. Second place went to The Founders Fund, while Accel Partners and Andreesen Horowitz shared third place.

All numbers as of March 31, 2014.

The California Gold Rush

California continues its reign as the venture capital state. In fact, all funds in the top 10 are based in California, with the exception of The Raine Group, which is based in New York. Raine garnered the number 8 spot by raising $366,850,000 for its second fund. Coincidentally, Raine counts Marc Andreessen of Andreesen Horowitz as an advisory board member. It looks like his magic may be contagious.

Where is the Money Going?

While the majority of the funds are focused on traditional venture-backed industries — internet, infrastructure, financial services, and software – The Founders Fund has added aerospace and machine intelligence, while Raine is focused on entertainment, media, sports, and lifestyle. Nonetheless, software continues to be the most highly funded sector as we move into a frothy venture capital market.

Strike While the Iron is Hot

There has never been a better time to raise capital. The past two years have been plagued by talk of a Series A crunch leaving entrepreneurs nervous about their future. Finally, it appears the drought is over and entrepreneurs will begin to see the light at the end of the tunnel.

Are you raising capital this year? How optimistic are you about the market?

by lilibalfour | | think

Where Have All the Innovators Gone?

Growing up in Silicon Valley was a magical experience. The area was full of innovators who came to this country to build their dreams, which were built on ideas that served a real purpose. From 1939, when Hewlett Packard developed their first audio oscillator in a garage, to 1942 when the greatest minds pooled their resources together to support the defense industry heading into World War II, the brightest minds were attracted to building technology that would change the world.

By 1971, due to the growing number of semiconductor innovations, the region began to be referred to as Silicon Valley. Fast forward to 2014 and the landscape has been watered down by novelty apps, news aggregators, and get-rich-quick copycat companies. If we had to name this same region today, what would we name it?

I hope the world would recognize this region as an innovation hub for electric cars and electric health records, yet sadly we are known for social networking and sleek devices produced with slave labor.

HBO’s comedic take on Silicon Valley is the wake up call this region needs. We will laugh. We will reflect. And hopefully we will grow.

I hope our growth brings talented people to focus on innovations that protect the environment, eradicate disease, and improve overall health for all of the world’s people.

The Negative Effects

Some of the negative effects of the current landscape are innocuous, while others are life threatening. We have 20 year olds flocking to the region to build upon outdated and frivolous ideas. They may waste their time on a company that goes nowhere, but they earn valuable experience in the process. The most disturbing side effect is that real problems are going unsolved. Whether it be cybersecurity or treatments for cancer, there is a real need for talented people to focus on real innovation.

Are you tuning into the HBO comedy, Silicon Valley? Do you think it will have a negative or positive effect on innovation?